Incentives and Benefits

Objectives of Investment Law

Law 22-18 on investment is part of significant reforms aiming to build a dynamic economy, diversify away from oil dependence, and establish a new economic model centered around investment. The provisions aim to encourage investment in priority sectors, ensure sustainable regional development, valorize natural and local resources, prioritize technological transformation and innovation, and enhance the competitiveness of the national economy.

Beneficiaries of Advantages

Any individual or legal entity, resident or non-resident, intending to establish an Algerian law company in an economic activity producing goods or services (excluding excluded activities) can benefit. Individuals who have previously received tax advantages under different employment aid plans (ANADE, ANGEM, and CNAC) may also be eligible for AAPI investment incentives under certain conditions.

Types Of Eligible Investments

Establishing technical capital ex nihilo by acquiring assets to create a new activity of goods and/or services production.

Increasing production capacity by acquiring new means of production in addition to existing ones. Acquiring additional ancillary or related equipment doesn’t qualify as an extension.

Operations to bring existing materials and equipment into conformity, addressing technological obsolescence or temporal use issues, increasing productivity, or restarting an activity stopped for at least three (3) years.

Transferring all or part of a company’s activities from abroad to Algeria.

Incentive Regimes And Associated Advantages

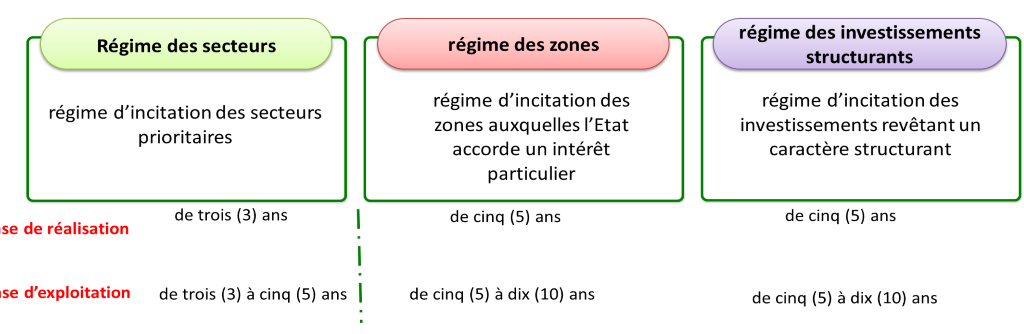

Investments can benefit from different incentive regimes based on the sectors of activity.

The following sectors are eligible for the “sectors regime”:

- Mines and quarries.

- Agriculture, aquaculture, and fishing.

- Industry, food industry, pharmaceuticals, and petrochemical industry.

- Services and tourism.

- New and renewable energies.

- Knowledge economy and information and communication technologies (ICT).

Investments in specific localities qualify for the “zones regime”:

- Localities in the Highlands, the South, and the Great South.

- Localities requiring special state support for development.

- Localities with potential natural resources for development.

For a list of eligible localities, visit the Agency’s website www.aapi.dz.

Investments with significant potential for wealth and job creation, enhancing territory attractiveness, and stimulating sustainable economic development qualify for the “structuring investments regime”.

Eligible investments meet these criteria:

- Direct employment level: ≥ 500 jobs.

- Investment amount: ≥ 10 billion Algerian dinars.

- Sectors include agriculture, aquaculture, fishing, industry, food industry, pharmaceuticals, petrochemicals, services, tourism, new and renewable energies, and ICT.

Benefits Granted To The Three Schemes

In addition to common law tax, para-fiscal, and customs incentives, eligible investments may receive:

During realization period:

- Customs duties exemption on imported goods for investment implementation.

- VAT exemption on imported or locally acquired goods/services for investment implementation.

- Transfer tax, land registration tax exemption on property acquisitions for the investment.

- Registration fee exemption on corporate acts and capital increases.

- Registration fees, land advertising tax, and state-owned property remuneration exemption on concessions for investment projects.

- Land tax exemption on real estate properties related to the investment for ten years from acquisition.

During operation period:

- Corporate income tax (IBS) exemption.

Additional Advantages for Structuring Investments Regime

- Possibility to transfer realization period advantages to investor’s contractors.

- State support for development works and infrastructure may be provided based on agreement between investor and Agency.